Post-COVID-19 Emerging Retail Trends

The global economy is entering a precarious and unprecedented recession brought on by the ubiquitous effects of the coronavirus pandemic. The Bank of England recently forecasted that the UK could experience a decrease in GDP of 14 percent by the end of 2020, fueled by a 25 percent decline in the second quarter; a worrying statistic when you compare this with the 2008 financial crisis where GDP fell by 4.8 percent. In April 2020, research and advisory firm, Forrester, reported that due to the impact of COVID-19, we would see a $2.1 trillion lost sales across the retail market globally, $70 billion of which would be attributed to the UK market. They also predict it will take 4-years to recover to normal sales trends; which was the pattern we saw following the 2008 crisis.

There are two other key performance indicators that significantly affect customers’ discretionary spend: Unemployment in the UK, which the Office of Budget Responsibility (OBR) predicts will reach 10 percent in the second half of 2020 – and that, I believe is a very optimistic number – again, this is set against the 8.1 percent unemployment in 2009. This results in the lowest UK Customer Confidence levels ever recorded – Mintel’s Customer Confidence Index dropped to 26.1 percent in April this year; historically, when that index experiences a fall greater than 20 percent, recession inevitably follows.

These figures represent the enormous challenges that retailers will face as they attempt to overcome a severe decrease in consumer confidence and the UK’s worst economic slump since the financial crisis in 2008, which is indicative of similar declines all over the world.

Clearly, there will be tremendous headwinds for retailers as customers emerge into the post COVID-19 world of retail. We are already seeing several emerging and growing trends which, smart retailers will need to adapt to. These are:

Price Consciousness and Value Consciousness:

McKinsey recently reported that 44 percent of adults in the UK strongly agree with the statement “That there’s a need to watch every Pound spent”. Interestingly though, the under 25’s have more confidence than any other demographic, perhaps because they are generally protected by Government schemes and right now have more disposable income.

We’re seeing the evidence of this cautiousness as countries around the globe emerge from lock-down. 40 percent of customers in China are spending very cautiously; the other 60 percent are typically spending at 80 percent of their normal spend. Closer to home, fashion sales across Germany 5-weeks post lock-down, are trading at 82 percent of last year’s trading levels.

This trend has ‘stickiness’; and is further evidenced in an emerging consumer trend with consumers either ‘Trading Off’ or ‘Trading Down’.

Brands and Products – Trading Up, Trading Off, Trading Down?

Given some of the recent availability issues customers are experiencing, for both brands and specific products, has led to a degree of polarization regarding customers’ choices to specific brands and products. In a recent BCG study, 36 percent of consumers polled are either ‘Trading Up’ – more expensive products or brands in their basket; ‘Trading Off’ – often cheaper, sometimes more expensive products or brands in their basket; or ‘Trading Down’ – less expensive products or brands in their basket.

Whilst it’s a truism that higher income earners are typically trading up, those on furlough, or redundant, Millennials, Generation Z, and lower income earners are typically trading down or trading off. What’s interesting is that 47 percent of those trading off are focusing on more environmentally (conscious consumerism) brands and products.

The question of course is, will this polarizing trend stick and put pressure on brands that are positioned in the ‘middle’?

Localism, Community and Conscious Consumerism:

Lock-down as well as a reluctance and fear of using public transport – 58 percent of polled adults in the UK (Mintel) wanting to avoid public transport – has resulted in customers engaging in their local environments. Mintel further reports that in the UK, 55 percent of polled adults try to buy from local retailers where possible. This is even stronger in Italy at 72 percent. It will be interesting to see for how long and if this trend remains in place.

Recent data from Kantar, for the 12-week period to mid-May 2020, shows stellar results for the food convenience sector, with the Co-op recording revenue growth of 31 percent and at Independent and Symbol stores, a 63 percent growth.

Mike Coupe, ex CEO, Sainsburys, reflected “We’ve seen a return to the 1970s and the way my grandmother used to shop – local greengrocers, butchers, delis are all doing incredibly well, and local convenience stores near to where people live are doing incredibly well.” The question is, can these retailers retain some of the growth?

Mintel also reported that 57 percent of Chinese consumers are still shopping in their local communities and 54 percent of German consumers feel it’s important to be a part of the local community.

This localism has also resulted in a stronger community spirit, evidenced in the UK with Thursday evening’s ‘Clap for Carers’ and the heartwarming stories of 100-year old Captain Tom, now of course Sir Thomas Moore, following his recent Knighthood and award of Honorary Colonel.

Consumers are also having to make do with some merchandise availability issues, especially around imported foods and some of their favourite brands. This has led to some consumers questioning how much ‘stuff’ they really do need to buy and accelerating a trend to conscious consumerism that was growing pre COVID-19.

Shopping Confidently – Safety Concerns

Even thrifty consumers will carefully choose which retailers to patronize according to the level of safety and protection that a specific retailer exhibits.

Early data from both Germany and Austria, around week-3 and 4 post lock down, a fashion retailer reported sales down year-on-year by minus 56 percent. However, customer footfall was minus 65 percent, so the basket size had increased. In Germany, in the last week of May, fashion sales were down minus 18 percent year-on-year.

Conversely, some of our own Gordon Brothers US projects that have started in recent weeks involving 873-stores have come out-of-the-box very strong – achieving year-on-year growth that’s better than expected.

The ‘Foodies’ who have traded through lockdown have certainly been pathfinders with social distancing initiatives in place, such as markings for queues and single direction aisles. Credit also to the British Retail Consortium (BRC), Union of Shop, Distributive and Allied Workers (USDAW), and the Government in providing clear guidelines for retail as we approach the June 15, 2020 – the planned date for retail opening in England.

Bringing the Outside In

How people have adapted to new (temporary or permanent) lifestyles is highlighted in a John Lewis recent report on shopping trends. For example, more and more families are taking time to sit down for a meal, baking with children, or with friends trying out new cocktails over Zoom. And, with 44 percent of us doing more exercise at home, John Lewis has benefited from an associated uplift in sales of gym gear and equipment since March 24, 2020, including a 72 percent rise in sports shoes, a 315 percent increase in Yoga and Pilates gear, and a 496 percent surge in gym equipment.

Furthermore, media products will likely continue to be purchased and consumed digitally whether outright or through streaming services, keeping physical sales of movies, music, TV, and video games suppressed and exacerbating pre-COVID-19 trends.

Another (of many) streaming examples, a leading Chinese beauty retailer Lin Qingxuan, using Alibaba’s Cloud eCommerce platform was able to transform its business model. One live-streamed session on Valentine’s Day attracted more than 60,000 people and, as a result, the retailer sold over 400,000 bottles of its camellia oil.

Nesting at home has meant that we have invested more in our homes, for example the technology sector has seen a boost in sales from people who are working remotely or home schooling their children. For consumers forced to stay home, the launch of the new Disney+ channel could not have been better timed.

Bringing the High Street to the home will certainly benefit eCommerce Pureplayers as well as omni-channel retailers.

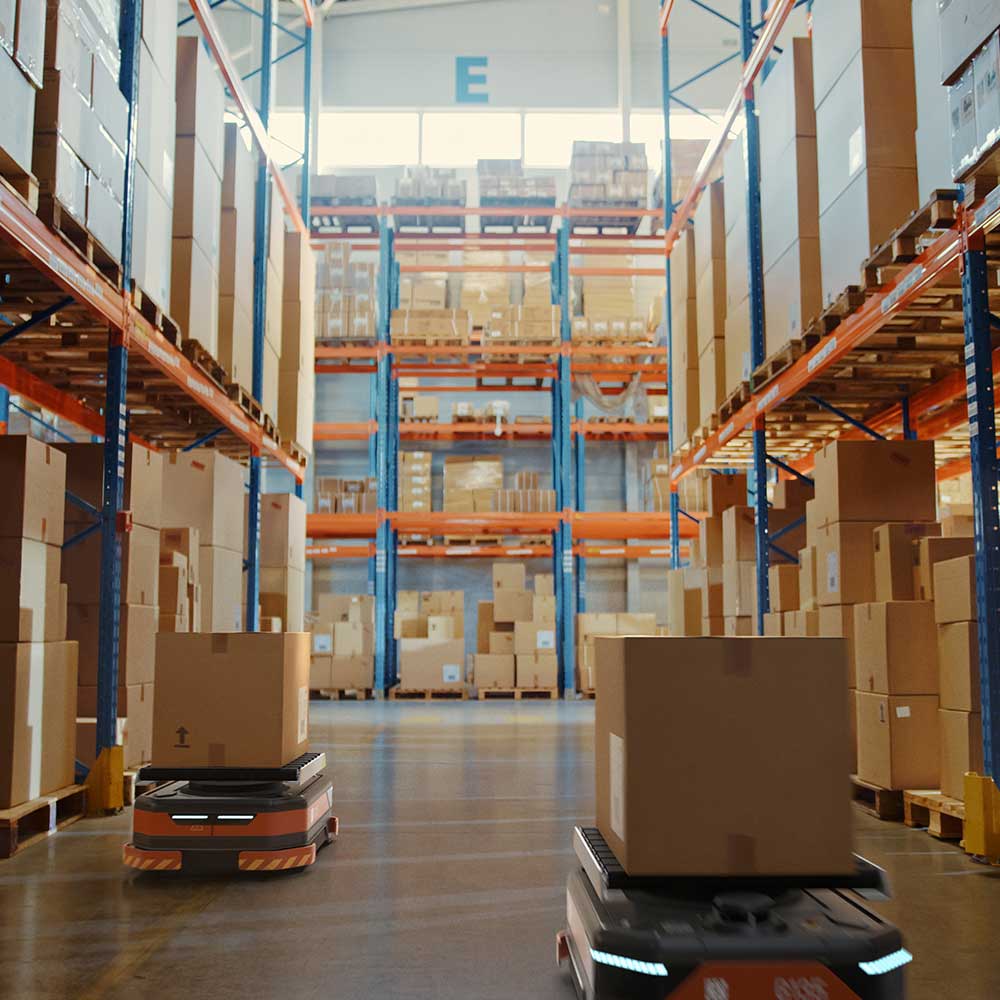

eCommerce:

eCommerce has experienced unprecedented growth levels over recent weeks. Based on BDO’s weekly sales tracker, for the week-commencing May 19, 2020, eCommerce grew 160 percent year-on-year in the UK, recording greater than 100 percent year-on-year for 5-weeks of the last 6-week period. By contrast, brick-and-mortar is down 87 percent year-on-year.

Home, DIY and fashion retailers have reaped online rewards, and visitor traffic to fashion and home and DIY websites recently has continued to grow despite the relaxation of lockdown measures.

Grocery eCommerce saw a dramatic rise of 14 percent in March (Nielsen). Recently though visits to grocery eCommerce sites are reducing, albeit the number of customers logging on to food websites remains much higher than it was prior to the pandemic.

Market leader Tesco for example, has seen its daily website traffic dip from 1.57 million in the week beginning May 3, 2020, to 1.44 million in the week starting May 17, 2020 – but remains almost double the 762k average daily visits it registered in the week beginning February 2, 2020, before the coronavirus took hold in the UK (Analytics by The Smart Cube).

With many online delivery slots reserved for the elderly or more vulnerable, the biggest change in eCommerce will be the addition of the elder demographic who may have been forced to overcome anxieties about using technology to shop online. The rise of the Silver Surfer – will it stick as a trend?

A need to Change and Adapt

Despite these challenges, there is still room for certain business models to grow and flourish. Asset-less businesses offer a benefit to investors and businesses that are looking to lock in that permanency in restructuring a retail chain or brand. Given recent challenges for some traditional brick-and-mortar retail models, more companies are looking to monetize Intellectual Property (IP) through licensing models and leasing a brand’s name, logo, or IP.

Gordon Brothers is looking closely at this type of asset class as a means of generating revenue for a brand and extending its global reach.

Gordon Brothers recently acquired the global Laura Ashley brand with a strategy to expand its portfolio of licensees and franchisees, bolster the brand’s ecommerce presence, and develop strategic wholesale relationships going forward. These types of models also allow brands and their inventors an opportunity to restructure brick-and-mortar and modify how consumers approach brand loyalty. Through strategic licensing arrangements and specialist companies, a brand can delegate many of a retailer’s complexities, obligations, sourcing, distribution, and logistics.

For retailers, perhaps – “It is not the strongest of the species that survives, nor the most intelligent; it is the ones most adaptable to change.” — Charles Darwin, British naturalist. And here’s a great example – Pret-A-Manger has started selling its range of coffee through various Supermarkets, cleverly anticipating a decline in demand from office-workers for its cappuccinos and lattes.

Before the COVID-19 pandemic, structural changes in retail were already evident. What the pandemic has done is accelerate those changes. It’s likely that we’ll see 10-years’ worth in as many months. At Gordon Brothers we have extensive resources to help you navigate these changes. Whether it’s monetizing unwanted assets, often with guaranteed results, or complex and creative re-structuring strategies.

Finishing on an optimistic note, the International Monetary Fund are predicting a sharp bounce back in 2021 with a 4 percent growth in GDP, and the Office for Budget Responsibility has predicted a wildly 12.8 percent growth! Let’s hope they are right.

For more information, please contact Nick Taylor at [email protected].