Tax Benefits of Personal Goodwill in Mergers & Acquisitions Transactions

For companies taking part in M&A transactions, the “goodwill” acquired in a deal can be a significant portion of the purchase price. Tax accounting distinguishes between “enterprise” goodwill, which relates to characteristics of the target company, and “personal” goodwill, which relates to characteristics of an individual within the target company, such as a business owner with strong customer relationships cultivated over a long period of time. The proper distinction between personal and enterprise goodwill can create significant tax savings for the seller by, among other benefits, leading to gains on personal goodwill assets that are taxed at capital gains rates rather than ordinary income tax rates.

Goodwill is “the value of a trade or business based on expected continued customer patronage due to its name, reputation, or any other factor.”[1] Although financial reporting under Generally Accepted Accounting Standards does not separate corporate and personal goodwill, tax accounting does. The accurate identification and quantification of personal goodwill is crucial for determining the optimal tax structure for an M&A deal. When selling a “C” corporation (or an “S” corporation that recently converted to a C corporation), and there are built-in-gains, the seller should consider the tax benefits of personal goodwill.

Personal Goodwill, Explained

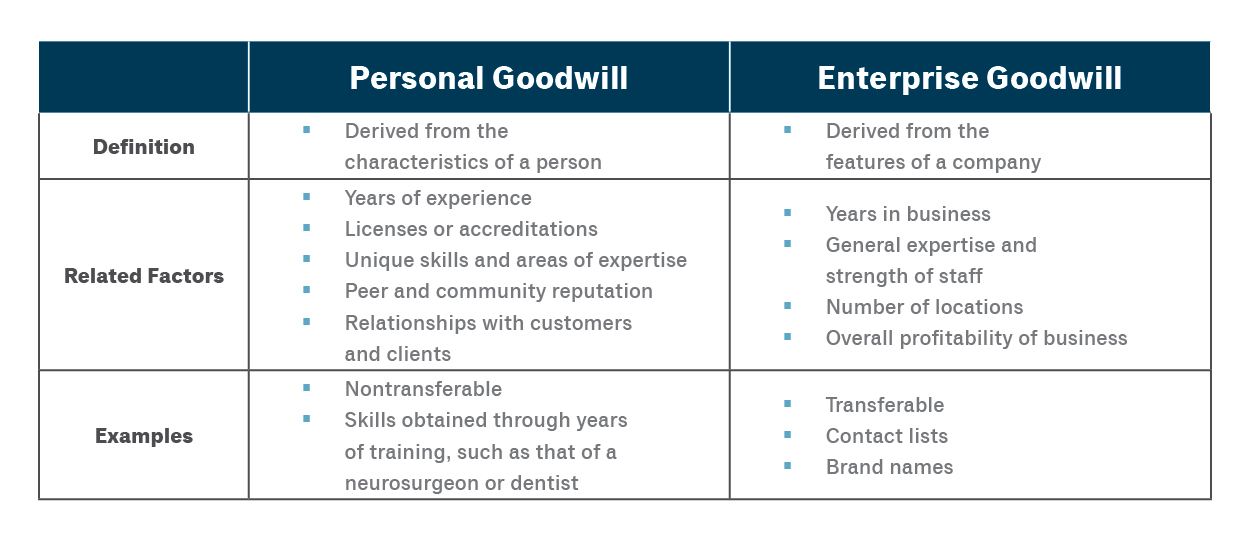

Most companies, especially those involved in mergers and acquisitions, are aware of enterprise goodwill. Personal goodwill results from a different combination of factors versus enterprise goodwill. See Table 1 for a detailed comparison.

Table 1: Personal Goodwill versus Enterprise Goodwill

Tax Implications

Sellers are often concerned about “double taxation” in M&A deals structured as asset sales, rather than stock sales. In such a transaction, the seller is first taxed at the corporate level for any gain on the asset sale; then, the seller is taxed again as a shareholder for any capital gains after the proceeds are distributed. However, if the sale is allocated to a personal asset, such as personal goodwill, the seller is only taxed once (at the individual level when the proceeds are distributed to the individual), because the employee’s personal relationships are not considered corporate assets. This nuance could have meaningful implications for deal structuring and tax obligations.

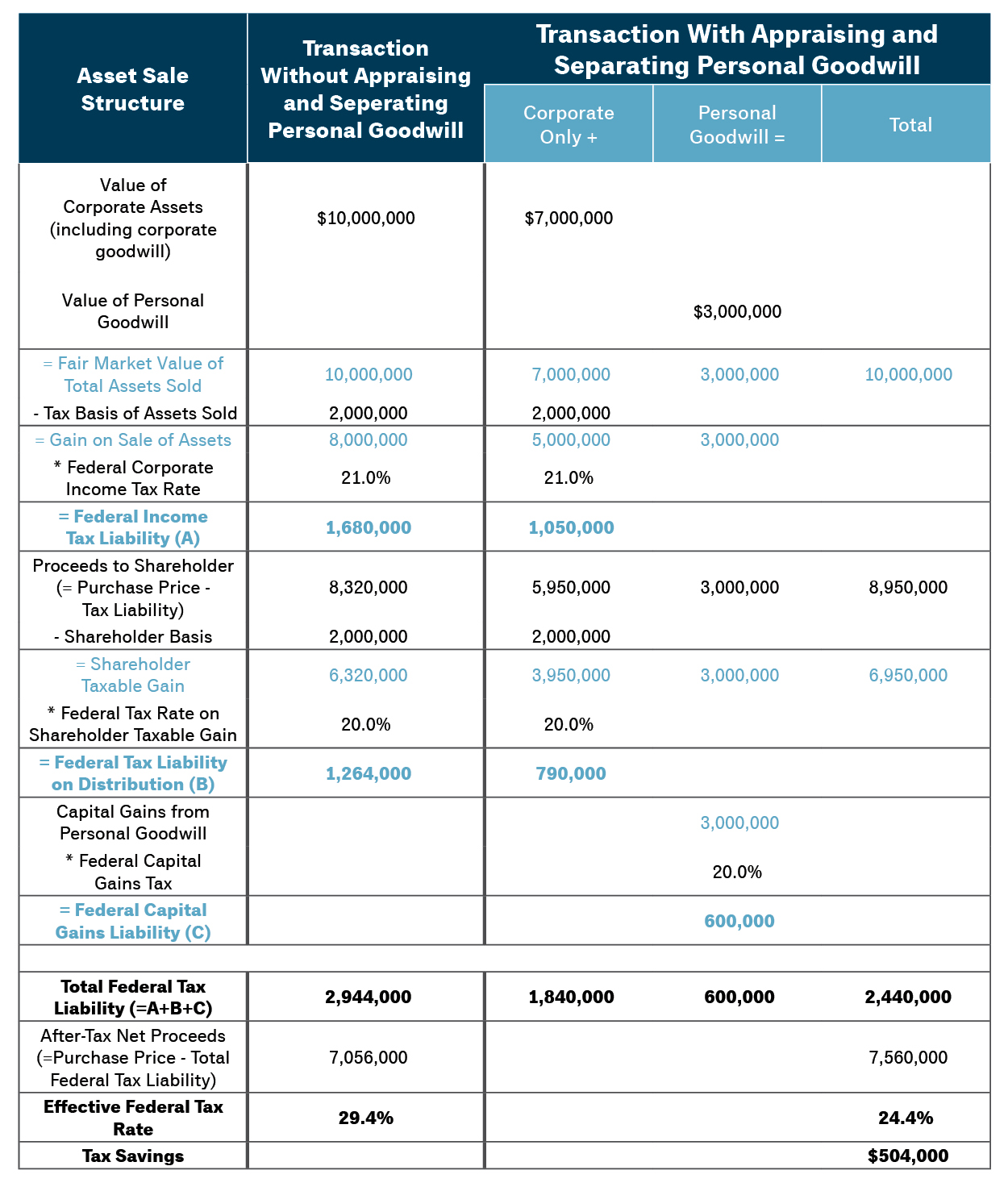

Table 2: Personal Goodwill-Related Tax Savings: A Hypothetical Deal Example

The example in Table 2 illustrates the potential tax savings for a transaction structured as an asset sale in which personal goodwill was recognized. In this scenario, recognizing personal goodwill reduced the effective tax burden from 29.4 percent to 24.4 percent, translating to a tax savings of $504,000 for the seller.

Relevant Court Cases

Certain court cases have been useful in providing precedent for distinguishing between corporate and personal goodwill. Over the course of 20+ years, various methods of determining pure personal goodwill have been tested in the courts, including the following cases:

- Martin Ice Cream Co. v. Commissioner[2] – In this case, the Tax Court ruled that intangible assets embodied in the shareholder’s personal relationships with key suppliers and customers were not assets of the shareholder’s corporation because there was no employment contract or non-compete agreement between the shareholder and the corporation.

- Norwalk v. Commissioner[3] – The Norwalk case centered on the tax implications of the liquidation and distribution of assets of an accounting firm (a C corporation). The two shareholders of the firm elected to terminate the company and to distribute its assets because the business was not profitable. The IRS maintained that the firm had realized a gain on the liquidation of its goodwill, and that the shareholders had realized a capital gain from the distribution of goodwill from their accounting firm to them. Although the shareholders had employment agreements with the firm prior to its dissolution, these agreements expired at the time of the liquidation.

- Lopez v. Lopez[4] – With respect to professional practices, Lopez v. Lopez suggests several factors that should be considered in the valuation of professional (personal) goodwill:

- The age and health of the individual

- The individual’s demonstrated earning power

- The individual’s reputation in the community for judgment, skill and knowledge

- The individual’s comparative professional success

- The nature and duration of the professional’s practice as a sole proprietor or as a contributing member of a partnership or professional corporation

Personal goodwill is a concept that evolved in litigation matters, specifically in marriage dissolution cases. While the term “personal goodwill” does not appear in the Internal Revenue Code, it is a creation of case law and was established by the above-mentioned case, Martin Ice Cream Co. v. Commissioner, 110 T.C. 189 (1998). In that decision, the Tax Court reaffirmed that when a corporation has no employment contract with an employee (in this case, the owner), the employee’s personal relationships are not corporate assets. Martin Ice Cream recognized that personal goodwill may be unique and will be present only if supported by particular facts. This case, and others, established that there can be personal goodwill if there is no employment agreement, non-compete agreement or other such agreements between the corporation and the employee. If there are such agreements in place, the goodwill reverts to the corporation and becomes part of corporate goodwill.

Quantifying Personal Goodwill

To quantify the value of personal goodwill, valuation experts use various methodologies, consisting of the following:

With versus Without Method – This method calculates the business enterprise value of the company overall, with and without the key individual that is expected to have personal goodwill. This method determines the amount of income that would be lost if the efforts of the key individual ceased, or if the key individual were to compete directly with the company.

For example, an individual starts a company that sells a specific product. Over the years, he develops solid personal relationships with his customers. If he were to compete against the company he founded, many of his customers would likely accompany him away from his original business. If he were not bound by a non-compete agreement (or other employment agreement terms), his personal relationships would be considered personal goodwill, not corporate goodwill.

Bottom-Up Method – This approach applies a similar methodology as is used in a standard purchase-price allocation analysis. The appraiser allocates the value of the enterprise to both tangible and identified intangible assets, and any remaining value is attributable to personal goodwill. However, the separation of corporate versus personal goodwill can still be uncertain if the appraiser uses this methodology only.

Top-Down Method – This approach values the business enterprise, but then uses a qualitative methodology to separate personal goodwill from enterprise goodwill. The Multi–Attribute Utility Model (MUM), which is a point–scoring method, can help separate the two types of goodwill.

For example, an individual founds and grows a company named after herself that sells a certain type of replacement product. In this example, the founder is the inventor of the product, the creator of the manufacturing infrastructure, the expert in her industry, the person holding relationships with key suppliers and a philanthropist supporting her community. In this case, the MUM is used to attribute a portion of the business enterprise value to the individual’s knowledge, relationships, name and other personal characteristics. Further, the company does not have an employment agreement with the individual.

Structuring Considerations

If structured properly, the seller of personal goodwill can receive significant benefits with no adverse tax impact to the buyer. However, allocations of personal goodwill must be reasonable and objective. So, when determining whether a personal goodwill valuation is appropriate, a wide range of factors must be considered. Any individual anticipating that they may have personal goodwill in a company should consult a tax professional in addition to a qualified business enterprise and intangible asset appraiser.

Gordon Brothers has worked with business owners for decades and has the experience and credentials to perform personal goodwill appraisals. Our professionals have achieved certifications including Accredited Senior Appraiser (ASA) in business valuation and intangible assets, Certified Public Accountant (CPA), AICPA’s Accredited in Business Valuation (ABV), and Chartered Financial Analyst (CFA), among others.